Who Needs Credit Repair? …and What is a Credit Score?

Who Needs Credit Repair?

Credit repair is not about magically deleting accounts on your credit report. Contrary to popular belief no company is able to identify which accounts can be removed unless they go through the credit repair process first. A standard credit repair should dispute the negatives items over and over again until they are either removed or verified by the creditor(s) Should the account be verified credit repair is supposed to help you by providing additional steps such as “Debt Validation” and/or “Debt Settlement” also known as debt consolidation.

The Do it Yourself Credit Repair?

Credit repair, at its best, will address everything that contributes to your credit score. The technique will include sending dispute letters to the credit bureaus to clear up erroneous reporting. Deficiencies in your credit profile ought to be addressed as well; in the event you do not have the accounts you require to create higher scores a lovely credit repair service ought to offer you the guidance and assistance to rebuild your credit to insure the best outcome. And finally, you may benefit from appropriate score optimization tips. There’s lots of cases where cautious changes to existing accounts can produce major score improvement.

What Credit Repair Does Not Do

Managing the restoration of your own credit can be rewarding. But be cautious not to miss any opportunities. Before beginning the credit repair technique do your home-work. You must have an understanding of the Fair Credit Reporting Act as well as knowledge of the way the Fair Isaac FICO works. And in the event you have any collections on your credit document you will require to understand the Fair Debt Collection Practices Act and your state statutes of limitation.

Subtle Factors Count

But there is still more you require for success. You must have an understanding of the way the credit bureaus operate in the event you require your dispute letters to get processed to your satisfaction. You may require to spend some time browsing online credit forums or pick up a book on the subject before you start. If all of this seems intimidating, you ought to think about hiring a lovely credit repair service.

Choosing a Professional Credit Repair Service

For most people, the decision to make use of a professional credit repair service is the wise option. In the event you take this path you won’t must invest the time to master all of the skills you require to succeed. You will be comfortable knowing that all the angles are being addressed adequately. of the more time consuming and organizationally intensive tasks in the technique is managing dispute letters. Letters may require to be resent. Responses must be rebutted to when the results are not to your satisfaction. For what ought to be a moderate every month fee you can turn all of the work over to an professional and insure the highest likelihood of success with your credit repair.

What is a Credit Score?

The most usual credit score used today is the FICO score. Each of the credit bureaus estimates a FICO score and makes those scores available to lenders and creditors that would like to interpret the risk of exposure they are obtaining in the event that they select to lend money, broaden credit, or even forfeit a deposit.

A credit score are a measurement of risk factor used to evaluate a person’s credit worthiness. Credit scores are rendered from statistical models that think about plenty of factors in a person’s credit record such as bill-paying history, the number and type of accounts, late payments, collection actions, outstanding debt, and the age of accounts. A credit scoring process awards points for each factor. A total number of points make up a credit score. This score helps predict how likely it is that an individual will repay a loan and make the payments on time.

Different Types of Credit Score

The credit score agencies likewise sell their own different credit scores. For example, Experian supplies its clients with a scoring product called the PLUS score which is different than a FICO score. Credit-reporting companies also together introduced a different credit score, called Vantage Score to compete with FICO’s score.

Credit Scores are moderately confusing since the credit bureaus sell FICO credit scores under a different identity. Each of the credit reporting agencies accumulate knowledge differently from each other and changes knowledge in to credit scores differently. Consequently, you MUST have all different credit scores.

Why is a Credit Score named a FICO Score?

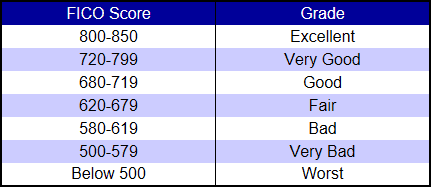

A FICO score is one type of credit score. Any credit score produced with the Fair Isaac formula is called a FICO score. FICO scores are the credit scores most lenders use to regulate there risk of exposure. Your FICO score is the most significant factor in regulating what rate you will pay when you take on a loan. The higher you improve credit score the greater possibility to to negotiate a lower interest rate. FICO scores range from 300 to 850. The score that a lender will bear depends upon the type of loan you are applying for.

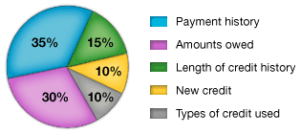

Although Fair Isaac does not unveil the inside information of their formula, they are for the most part based on five factors; Payment History, Amount Owed, Length of Credit History, Recent Inquiries and Types of Credit you have engaged in the pass.

How is a FICO Score analyzed?

Additional Credit Scores

You are able to visualize whether you have beneficial credit or risky credit by any of the credit scores beneath. Keep in mind, these scores will be contrary to your FICO scores and different from one another.

Experian Score PLUS

In 2009, Experian drew out of its agreement with Fair Isaac and discontinued furnishing a FICO score to its clients. Experian provides a Score PLUS which has a score range from 330 to 830.

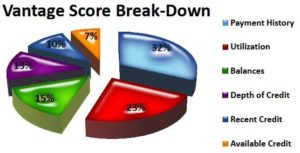

Vantage Score

Vantage Score was collectively formulated in 2006 by TransUnion, Experian, and Equifax instead of the FICO score, to attain credit scores easier to interpret. Although the three credit bureaus now produce scores applying the equivalent credit scoring model, you may see deviations in your scores since each one maintains its own consumer credit files, which might vary. Vantage Score ranges from 501 to 990, and the score is fractionated into five grade levels, from “A” to “F” with “A” representing the finest. Vantage Score is supplied by TransUnion and Experian.

TransUnion TransRisk Score

TransRisk is a consumer credit score that’s produced by TransUnion, one among the three credit bureaus. TransRisk scores models after FICO score, simply it Is not a FICO score. The score features a range from 300 to 850, the equivalent as the range of the FICO score.

Your credit report regulates your credit scores. Improve your credit report and your credit scores will provide you with lower interest and more acceptable monthly payments.

Not sure where you stand?

One of our friendly credit consultants is standing by to assist you in acquiring all 3 credit reports and current score in just a few minutes, If you desire to have your report and credit score analysis contact us NOW!

Make sure that the loan will be repaid in the time when you may be required to be interest and costs for the improvement as a punishment. Make the most of the loan.Still have questions? Contact us.