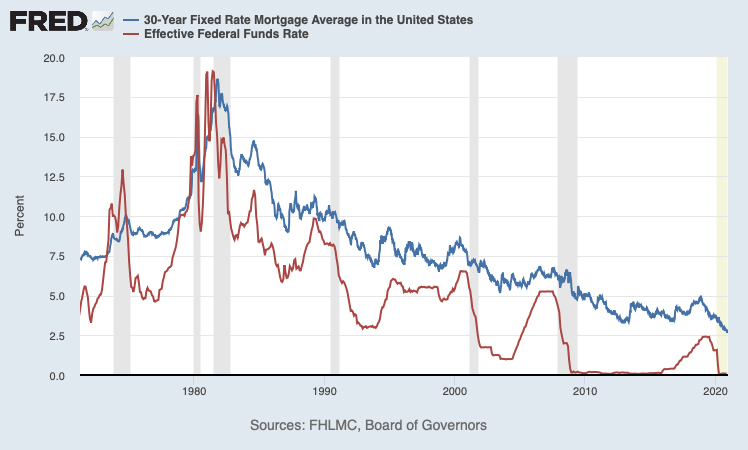

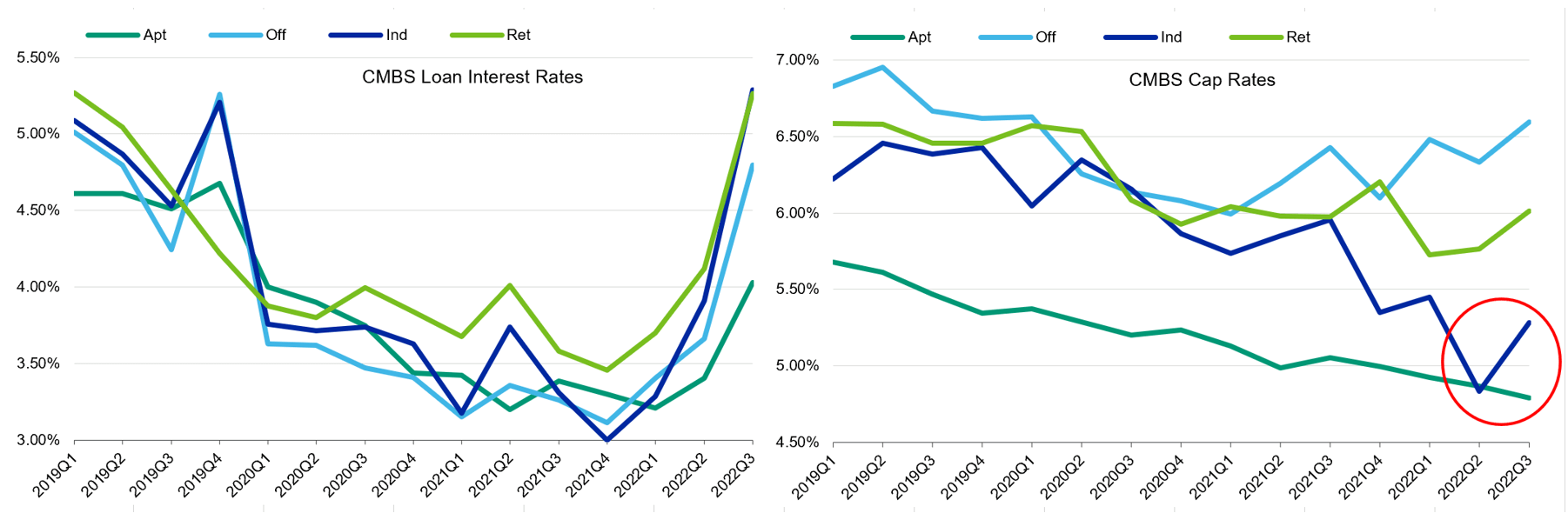

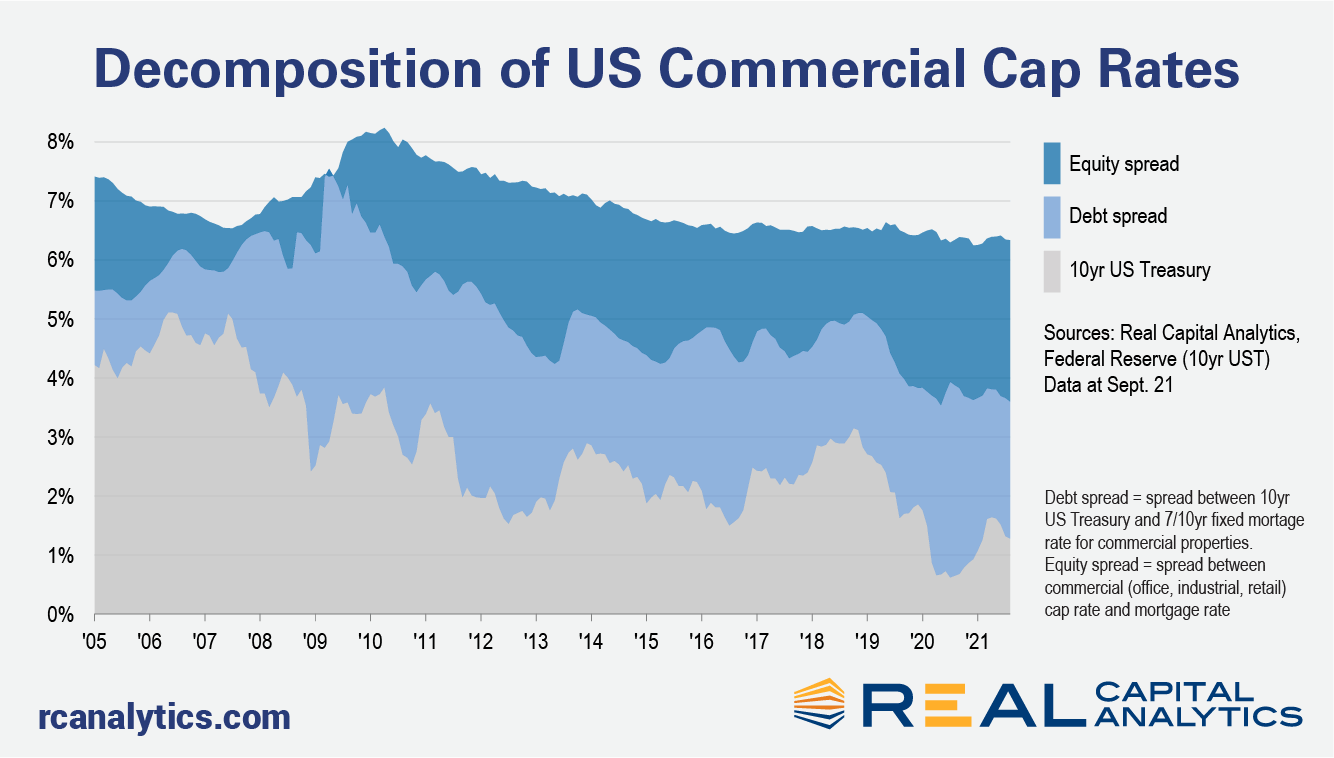

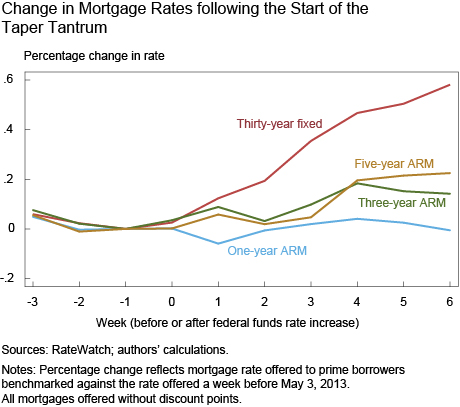

Does the Fed Funds Rate Increase Impact Fixed Rate Mortgage Interest Rates on a 1:1 Basis? — Breneman Capital - Multifamily Investment Firm

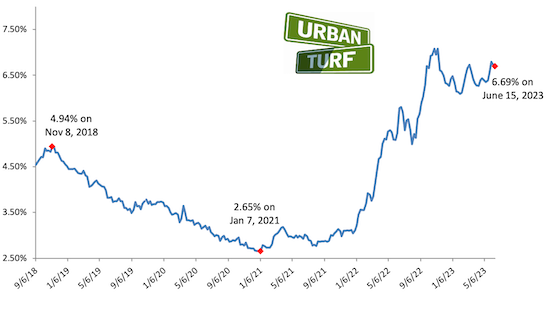

Mortgage Bankers Predict Mortgage Rates to Drop to 5.4% by End of 2023. A Year Ago, They Forecast 4% by Now, but Now We're at 7%. Wishful Thinking by Crushed Mortgage Lenders? | Wolf Street

Mortgage Bankers Predict Mortgage Rates to Drop to 5.4% by End of 2023. A Year Ago, They Forecast 4% by Now, but Now We're at 7%. Wishful Thinking by Crushed Mortgage Lenders? | Wolf Street

:max_bytes(150000):strip_icc()/DecemberMortageRatesNews-30-6507d0f82bcd4541a028f501162c9a88.jpg)