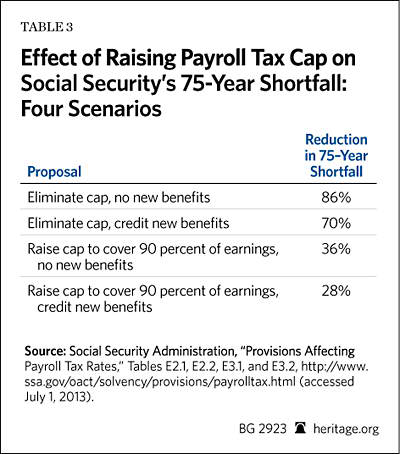

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

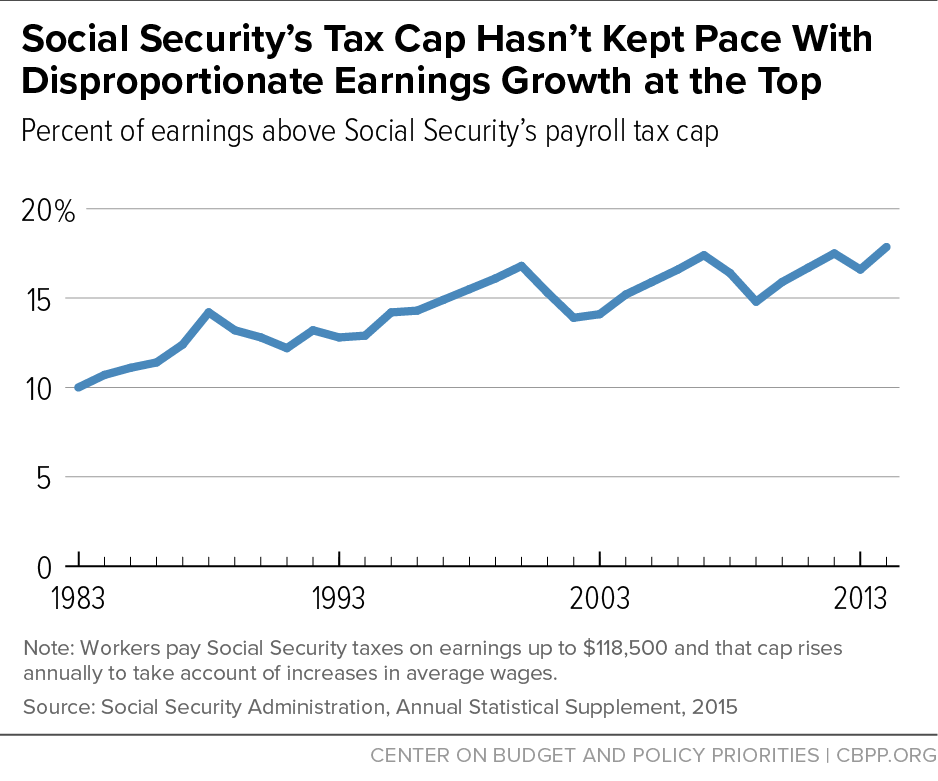

Unfair Cap Means Millionaires Stop Contributing to Social Security on February 28, 2023 - Center for Economic and Policy Research

![Social Security Earnings Limit [UPDATED] - YouTube Social Security Earnings Limit [UPDATED] - YouTube](https://i.ytimg.com/vi/tX8mJUnJUkA/maxresdefault.jpg)