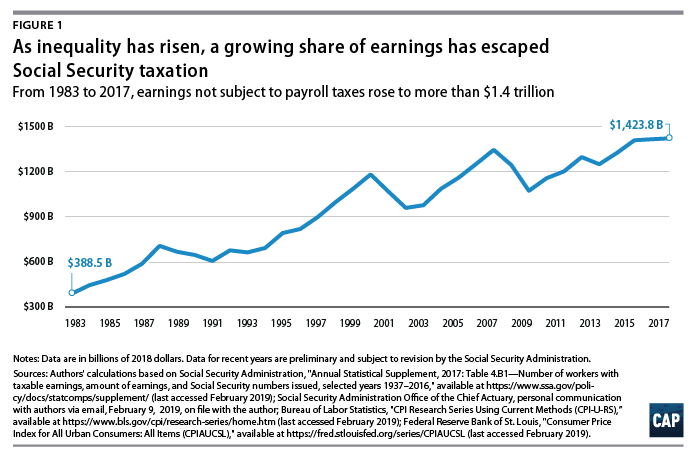

Here's How Much America's Rising Income Inequality Is Costing Social Security - Center for American Progress

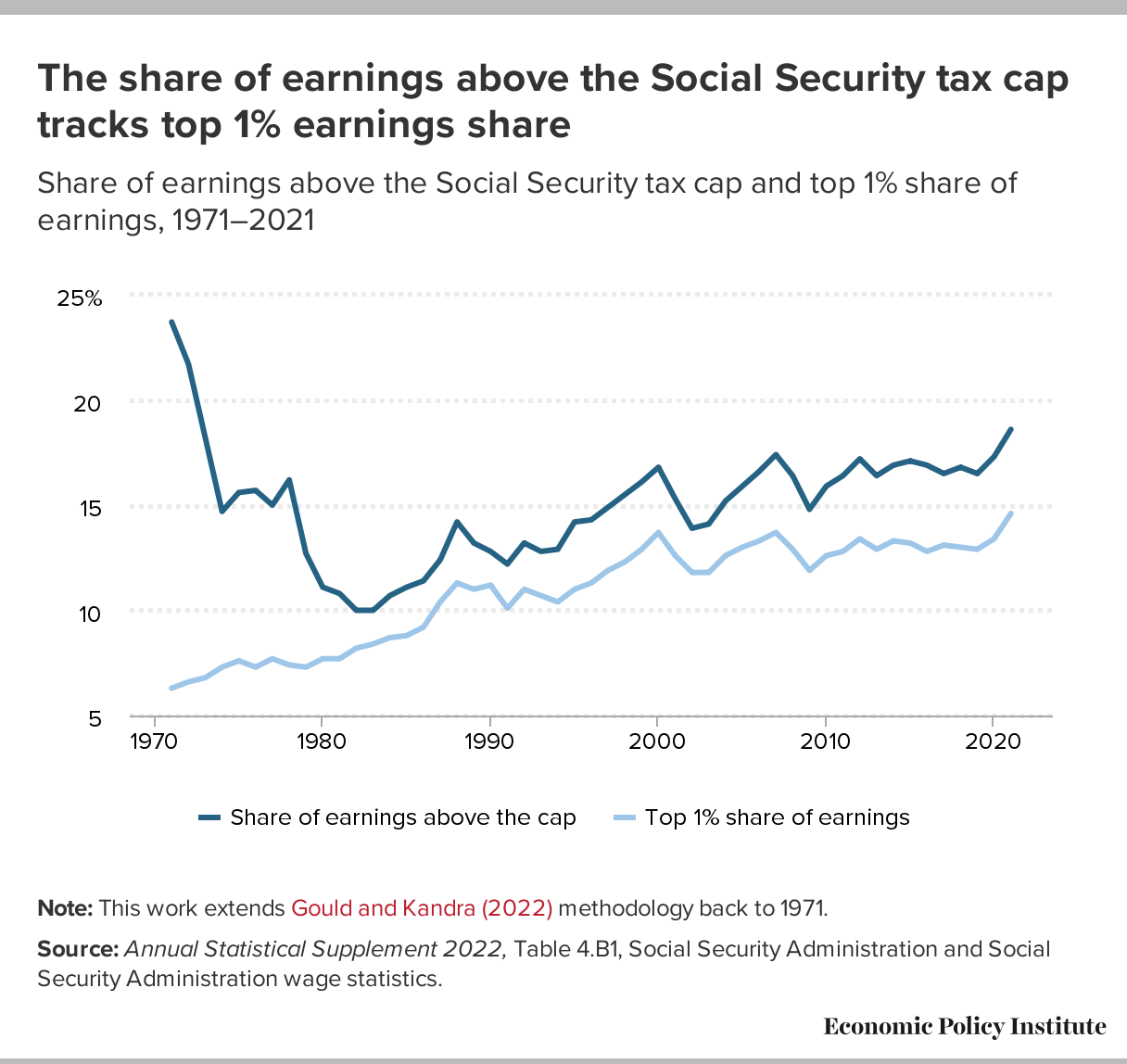

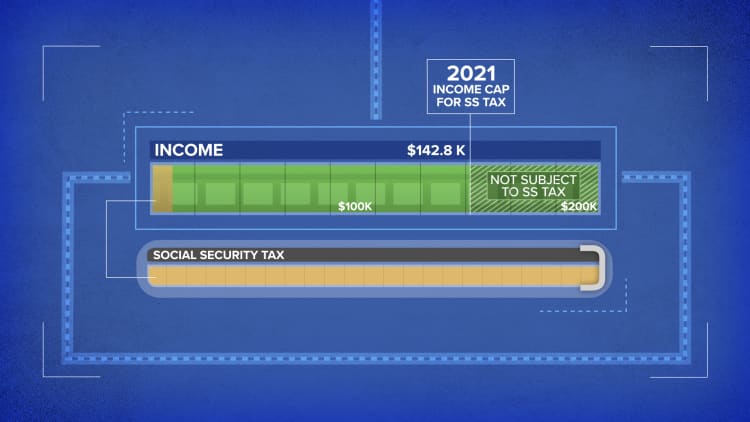

A record share of earnings was not subject to Social Security taxes in 2021: Inequality's undermining of Social Security has accelerated | Economic Policy Institute

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

![Social Security Earnings Limit [UPDATED] - YouTube Social Security Earnings Limit [UPDATED] - YouTube](https://i.ytimg.com/vi/tX8mJUnJUkA/sddefault.jpg)