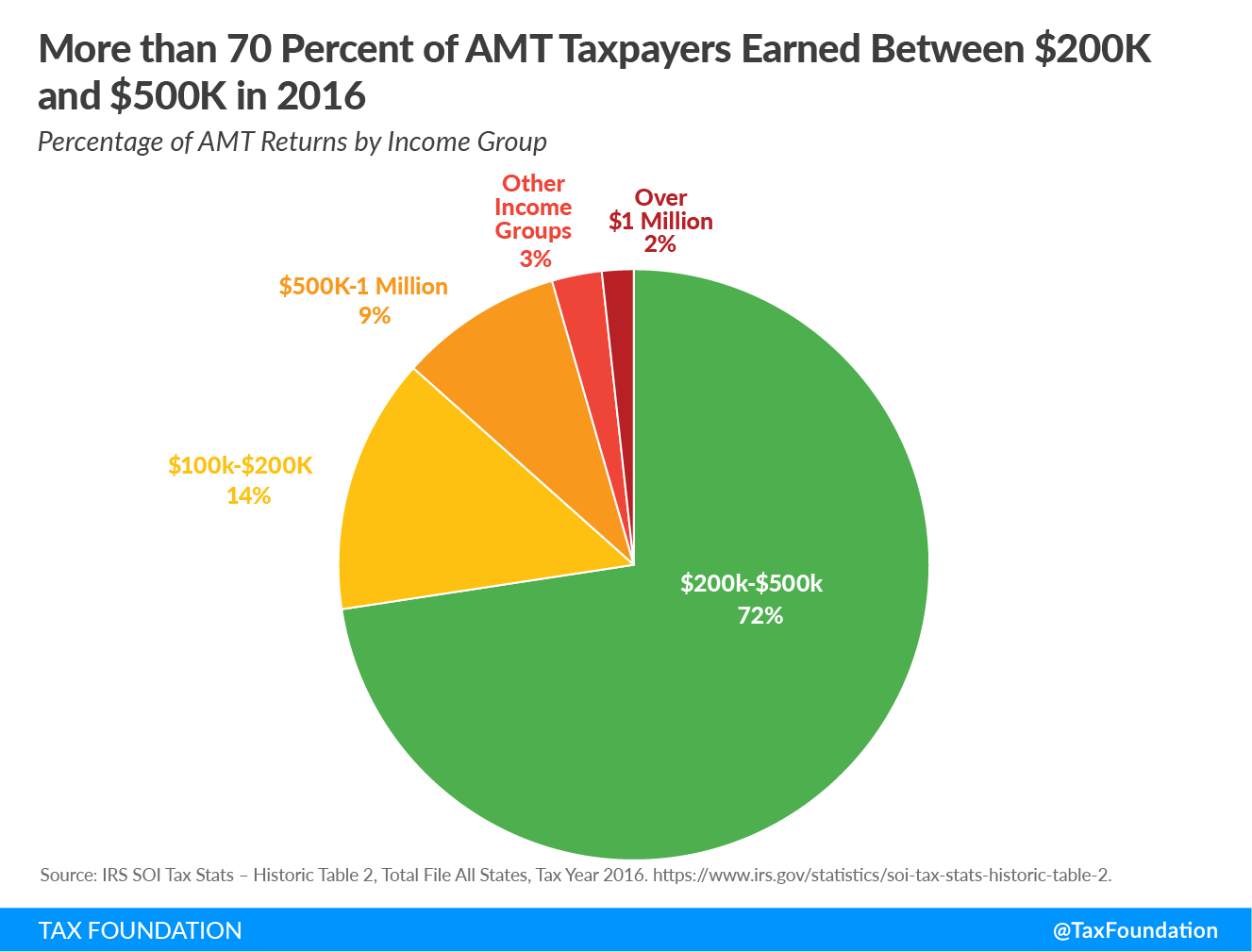

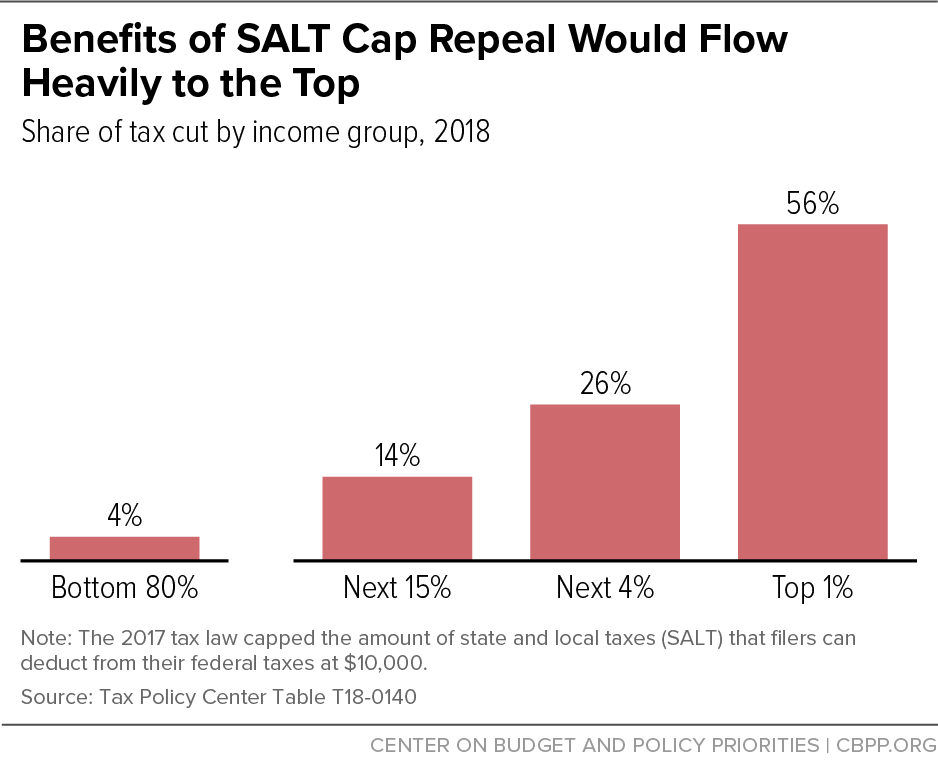

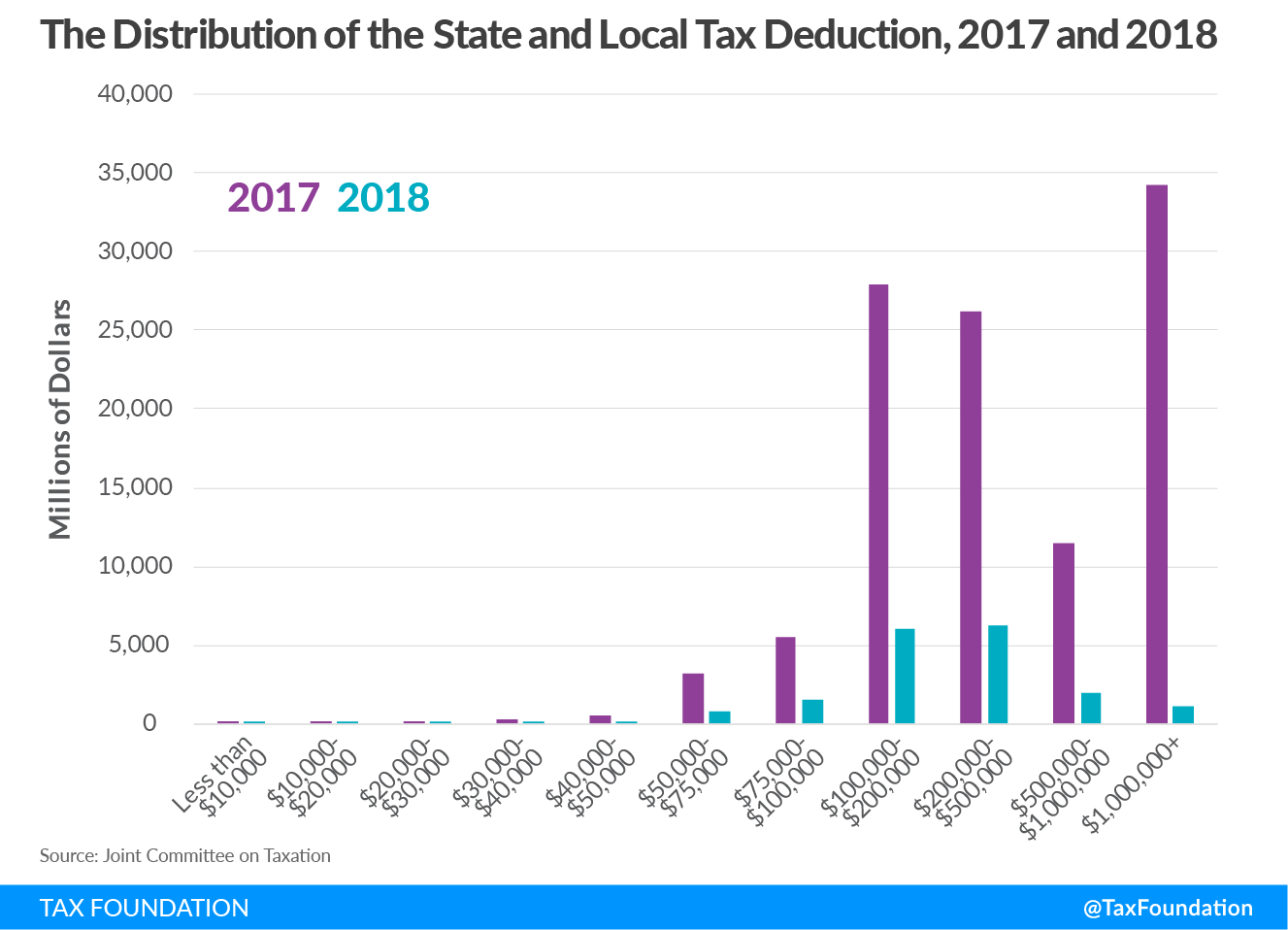

Repealing “SALT” Cap Would Be Regressive and Proposed Offset Would Use up Needed Progressive Revenues | Center on Budget and Policy Priorities

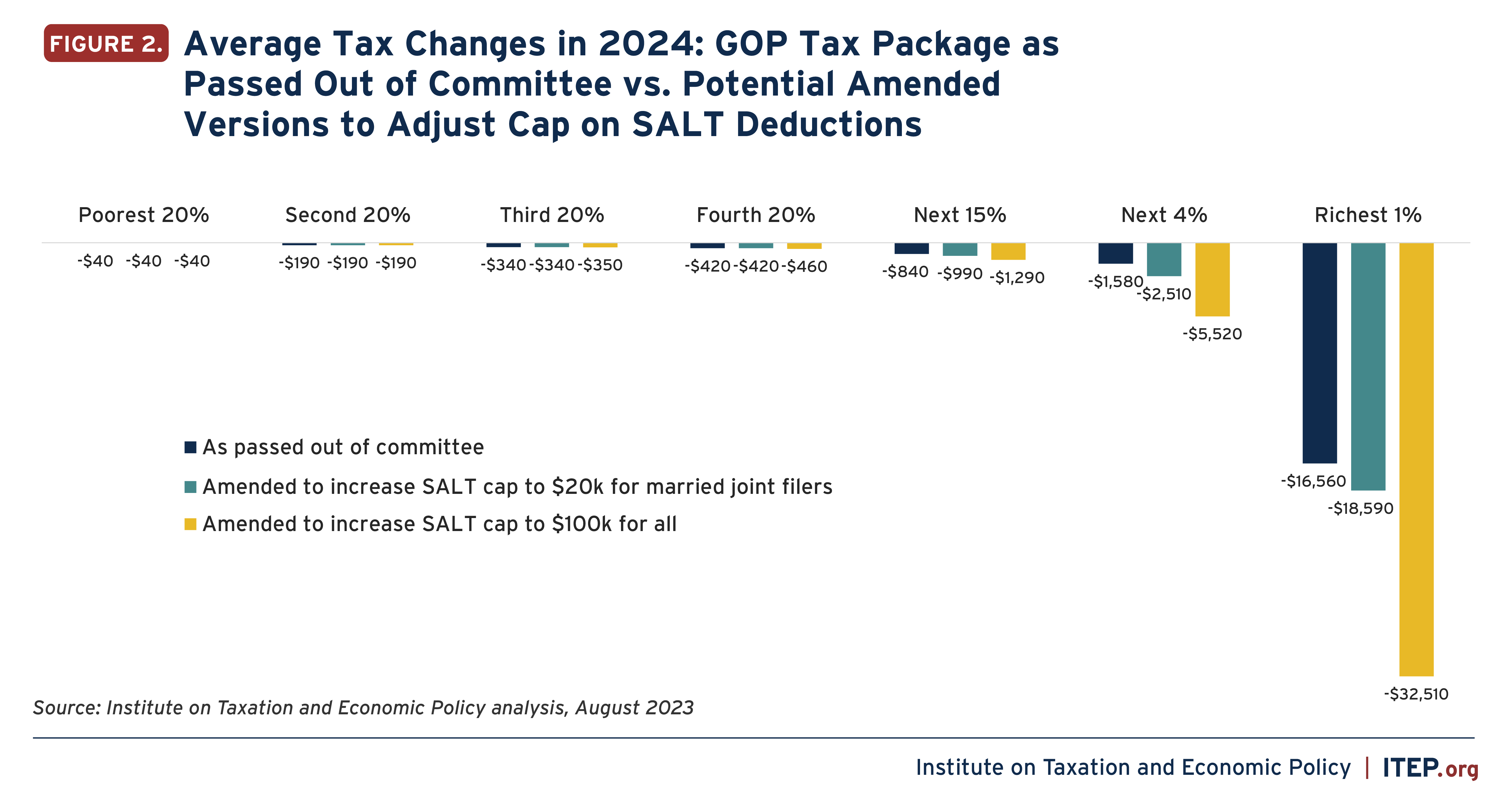

State and Local Tax (SALT) Deduction Legislation in the 118th Congress | National Association of Counties

My mom's sriracha expired almost 17 years ago. It somehow survived 2 moves and has barely been used. : r/mildlyinteresting

Weakening the SALT Cap Would Make House Tax Package More Expensive and More Tilted in Favor of the Wealthiest – ITEP

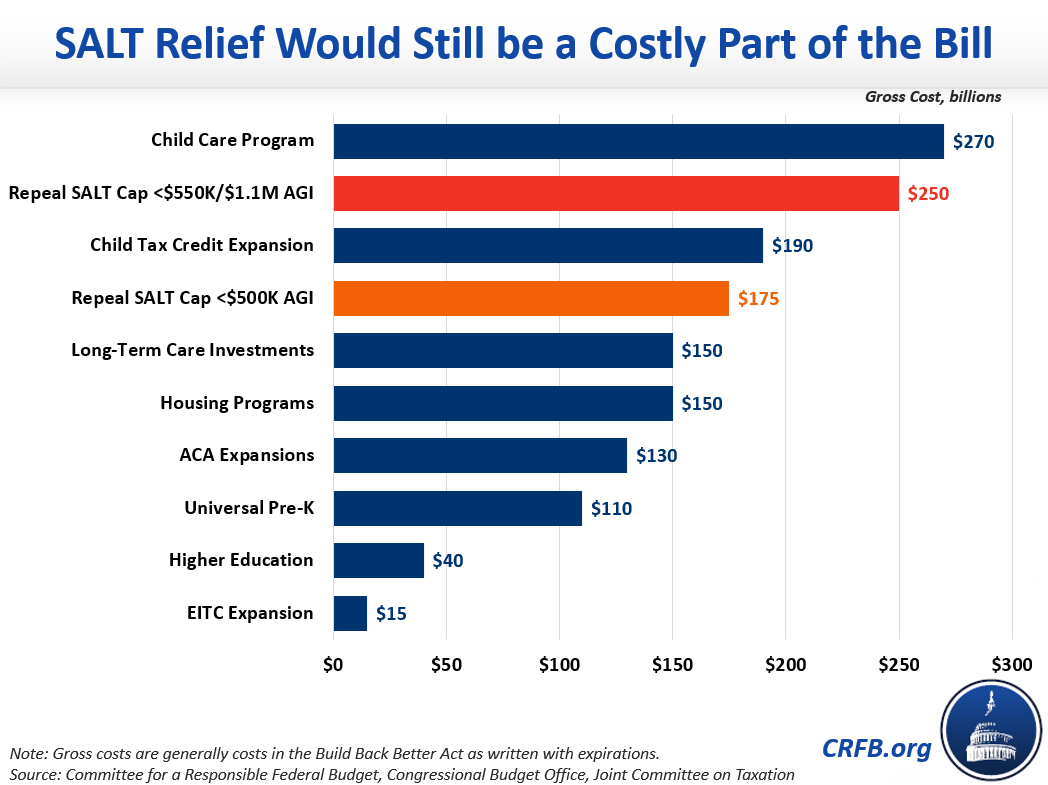

Revenue Neutral" SALT Cap Relief is Costly and Regressive | Committee for a Responsible Federal Budget

Repealing “SALT” Cap Would Be Regressive and Proposed Offset Would Use up Needed Progressive Revenues | Center on Budget and Policy Priorities

SALT Cap Repeal Below $500k Still Costly and Regressive | Committee for a Responsible Federal Budget

-PB_Full_Hero_2880x1620-v01.jpg.asset.880.495.jpg)